FHA Home Loans

What can a FHA home loan do for you?

FHA loans have been helping people become homeowners since 1934.

How do they do it? the Federal Housing Administration (FHA) - which is part of HUD - insures the loans, so that we can offer you a better deal.

- A FHA home loan allows for a low down payment

- Helps reduce the cash needed to purchase a home

- Down payment may be a gift

- Non-occupant co-borrower may be allowed

- FHA rates are lower in comparison to Conventional

- Cash Out Refis up to 85% LTV

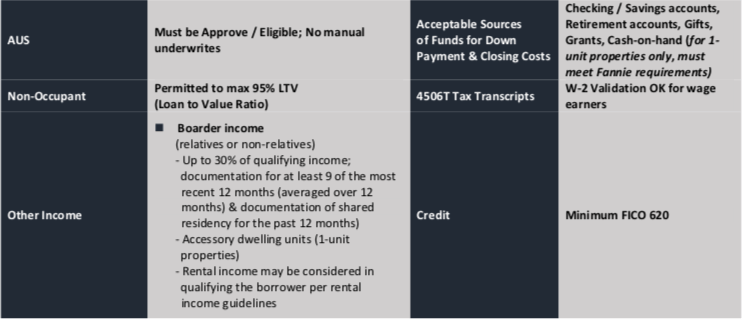

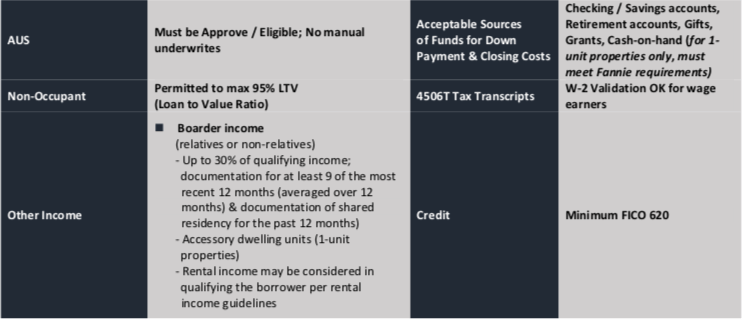

Home Ready® by Fannie Mae

Flexibility for today's homebuyers

- LOW DOWN PAYMENT

- Down payments as low as 3% with no minimum contribution required from buyer's own funds (1-unit properties)

- CONVENTIONAL HOME FINANCING

- Significantly reduced mortgage insurance (MI) rates

- Private Mortgage Insurance (PMI) may be eligible for cancellation when home equity reached 20%

- HOMEOWNERSHIP EDUCATION

- Helping buyers prepare for the responsbility of purchasing and owning a home. Required training availble online.

- HOMEREADY® MORTGAGE BORROWER INCOME ELIGIBILITY

No income limit! | Properties in low-income census tracts | 100% of area median income

For all other properties:

USDA Loan

A USDA Loan is a mortgage loan that is insured by the US Department of Agriculture and available for qualified individuals who are purchasing or refinancing their home loan in an area that is not considered a major metropolitan area by USDA.

Benefits of USDA Loans

- 100% Financing - you can buy a home with no money down. You can even finance your closing costs.

- You can refinance your home up to 100% of the value of your home.

- Low Fixed Rate Mortgage Options.

- They are usually easier to get because the Government insures the loan so that there is much less risk to the lender.

- They can be used for Existing Homes, Foreclosures or New Construction.

- Simple Loan Process.

- No Loan Limit. No Acreage Limit.

- There is No Prepayment Penalty.

- You can use the loan to repair or add on to your home.

- Flexible Credit Requirements.

Highlights

- Purhcase or Rate and Term Refinance options

Refinances fo existing Guaranteed Rural Housing Program GHP loans only

- 30 year fixed

- Single Family Residences, PUD, Condo, Leaseholds

- Max Loan to Value Ratio / Combined Loan to Value Ratio 100%

(CLTV can exceed 100% to include the financed guarantee fee)

Check to see if you qualify:

{FORMS_QUICK}

These materials are not from HUD or FHA and were not approved by HUD or a government agency.